4 6

Quantitative Investments

Expertise

Looking for ALPHA among many factors

Making it into one portfolio

We are continuously generating new strategies and models by processing large amounts of information with our software, identifying inefficiencies in different markets.

As we develop new algorithms, we are constantly looking for new information and incorporating it into models.

There is no perfect model. There is an optimal set of numbers of algorithms to achieve sustainability. Therefore, we do not rely on a single principle and compensate for the risk of error with the number of new algorithms.

By the time you finish reading this text we will have calculated over 100 new iterations.

Facts about the non-correlated with market ALPHA portfolio

Expertise

The key principle in this portfolio is to combine a large number (over 90) of non-correlated strategies into one portfolio using the Risk Parity model.

The main advantage of this portfolio is the lack of positive correlation with the US equity market (the average correlation of the portfolio's daily deviations with the S&P500 is 0.03).

- Over 90 strategies.

- Over 9,000 assets in one portfolio.

- Daily transactions are made on a daily basis.

- Use of the Risk Parity Model.

- Over 7000 backtests per minute.

- The target average annual yield is over 16%.

- Dynamic replacement/addition of new strategies

on a quarterly basis depending

on changes in market conditions.

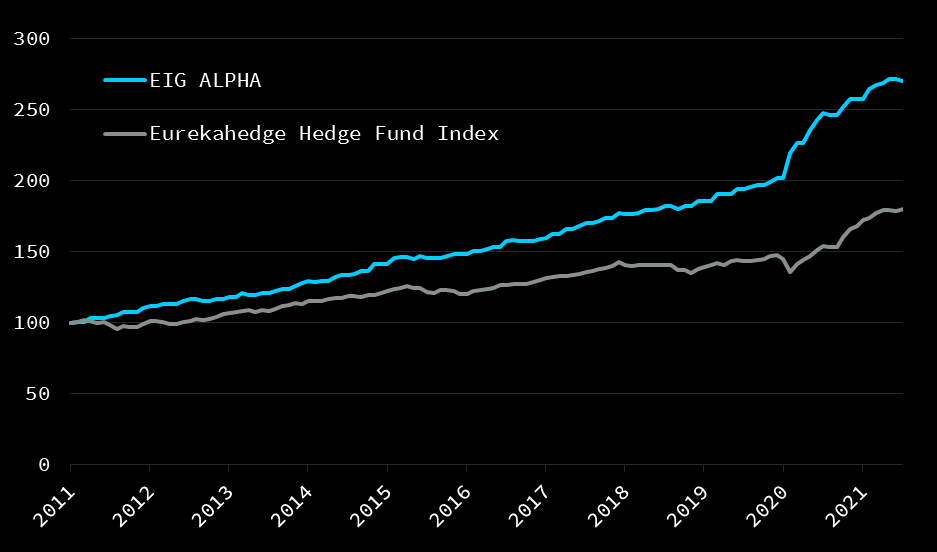

Comparison of the market-neutral EIG ALPHA portfolio with the benchmark

Eurekahedge Hedge Fund Index*

Superiority over the benchmark in 11 years 89.98%

with a Sharpe ratio of 2.3 versus 1.23 respectively.

72% of funds in the first pool of the launched ALPHA strategy belong to EIG employees.

* Eurekahedge hedge fund index (Bloomberg Ticker - EHFI251) - is Eurekahedge's main peer-weighted index, comprising 2,352 listed funds.